WE ARE REWARDED WHEN WE GIVE.

That’s why we created Spirit Rewards – because we believe in giving the BEST to our customers. Spirit Rewards is more than savings, more than cash back and more than benefits. It’s all those features wrapped up into one account.

Minimum Opening Deposit

$50

Maintenance Fee

$7

Can be reduced to $0 with $2 for eStatement and .20 for each additional debit card transaction2

Cash Back Rewards

Earn $.10 cash back for each debit card transaction3

Unlimited Check Writing/Account Privileges1

Always Free Benefits

- Imaged eStatement

- DIGITAL BANKING (Online & Mobile)6

- ATM/Visa® EMV (Chip Enabled) Debit Card9

- Unlimited ATM use5

- 24/7 Phone Banking

BaZing Benefits4

- 360,000 discounts where you live, work or travel

- Cell phone replacement protection8

- $10,000 travel accidental death insurance8

- ID theft protection

- Roadside assistance

Additional Rewards

- FREE Branded Checks7

- 25% Discount on Checks

1 – Debit items consist of all withdrawals by check, transfer of funds or drafts on the account. ATM and In-Bank withdrawals are unlimited.

2 – Maintenance fee will be reduced to $0 with eStatement and 25 qualified debit card transactions, or with a paper statement and 35 qualified debit card transactions.

3 – $.10 account credit for each qualified debit card transaction once maintenance fee reaches $0. Qualified debit card transactions include all PIN or signature-based transactions that post to your account within a statement cycle. ATM transactions excluded.

4 – All BaZing benefits are provided by a third party vendor. All benefits, including insurance coverage, are provided by StrategyCorps in conjunction with Member Headquarters Association of which your financial institution sponsors. This sponsorship results in an association membership being provided to each eligible customer and any co-owner of their account. Benefits of this program are subject to change without notice.

5 – Available at all surcharge-free FUB, MoneyPass and Stripes convenience stores ATMs.

6 – Mobile carrier fees may apply. See a Customer Service Representative for details.

7 – Limited to 1 box annually.

8 – The investment products offered are not FDIC insured. Products are not deposits, other obligations, not guarantees or insured by the Bank or any Federal Government Agency. Are subject to investment risk, including the possible loss of principle amount invested.

9 – First issued card is free. $5 replacement fee for lost or replaced cards.

Product offerings are subject to change.

We are rewarded when we give.

Our rewards come from giving our customers something greater.

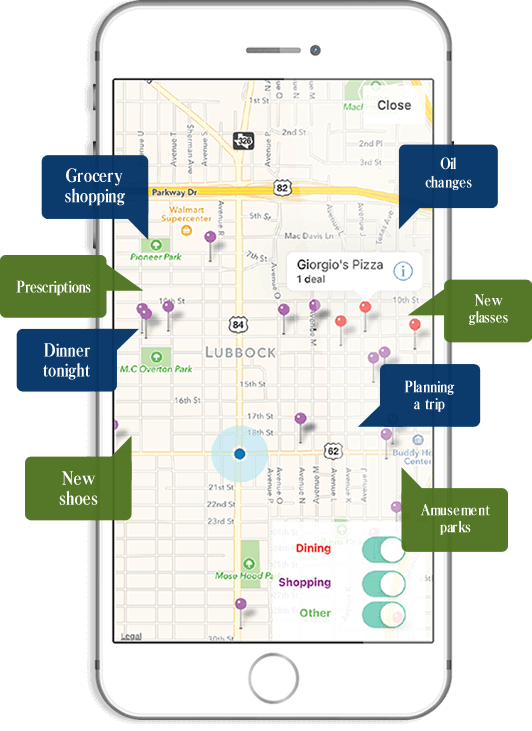

SHOP LOCAL. SAVE LOCAL.

BaZing brings 360,000 discounts where you live, work or travel.

BROWSE.

Get discounts that fit each day, each plan, each purchase.

SHOP.

The restaurants and shops you know and love are included in the BaZing savings network, right where you live and across the nation.

SAVE.

Simply show your mobile coupon to the retailer for instant savings.

- Activate at BaZing.com

- Download the BaZing mobile app

- Like us on Facebook

- Follow us on Twitter @BaZingDeals

Participating merchants on BaZing are not sponsors of the program, are subject to change without notice, may not be available in all regions and may choose to limit deals.

TRIPLE THREAT PROTECTION

Cell phone protection

Just pay your cell phone bill with your BaZing checking account, and you’re covered. If your phone is broken or stolen, we’ll pay to have it replaced, up to $200 per claim (maximum of $400 per year).

Identity theft protection

Payment card protection

If your payment cards are lost or stolen, you have a personal fraud specialist ready to assist you.

$2,500 in personal identity protection

Reimbursement for covered expenses you incur to restore your identity.

Identity theft aid

Unlimited access to personal fraud specialists who provide identity recovery and restoration assistance.

Roadside assistance

Lock your keys in your car? Car won’t start? Roadside assistance is available 24/7. It’s free to use, $64.95 in covered service charges.

Cell phone protection and personal identity protection are subject to additional terms and conditions.

ALWAYS FREE BENEFITS

Easy to use banking tools & other time saving benefits.

FREE Imaged eStatement

Digital eStatements are eco-friendly, convenient, encrypted for security and are more secure than paper statements.

DIGITAL BANKING

View account balances, check images & statement history, View deposits, Pay bills & transfer funds, Mobile deposit capture2, Picture pay2, Person-to-person payments, Switch debit card on and off, Personal Financial Management, Locate Banking Centers & ATMs

ATM/Visa® Debit Card3

Choose from an array of beautifully designed cards featuring the work of West Texas artist, Laura Lewis.

Unlimited ATM Use

At all surcharge-free FUB, MoneyPass and Stripes Convenience Stores ATMs.

24/7 Phone Banking

Sometimes, the friendly voice of a helpful West Texan is just what you need to hear.

1 – .50 per item after 10 items on eMerge Checking.

2 – Certain restrictions apply.

3 – First issued card is free. $5 replacement fee for lost or replaced cards.